Contents

MBIE has this week approved the first application for a Fair Pay Agreement (FPA) by interurban, rural and urban bus drivers. Now the hard work begins!

According to the Fair Pay Agreements Dashboard, MBIE is currently processing three further FPA applications affecting:

- Security guards/officers;

- The hospitality industry; and

- Supermarket and grocery store employees.

We understand that applications on behalf of early childhood workers and cleaners are in the pipeline.

It is unlikely that any FPA will be completed before the 14 October general election because the process is long and complex involving many areas of potential disagreement.

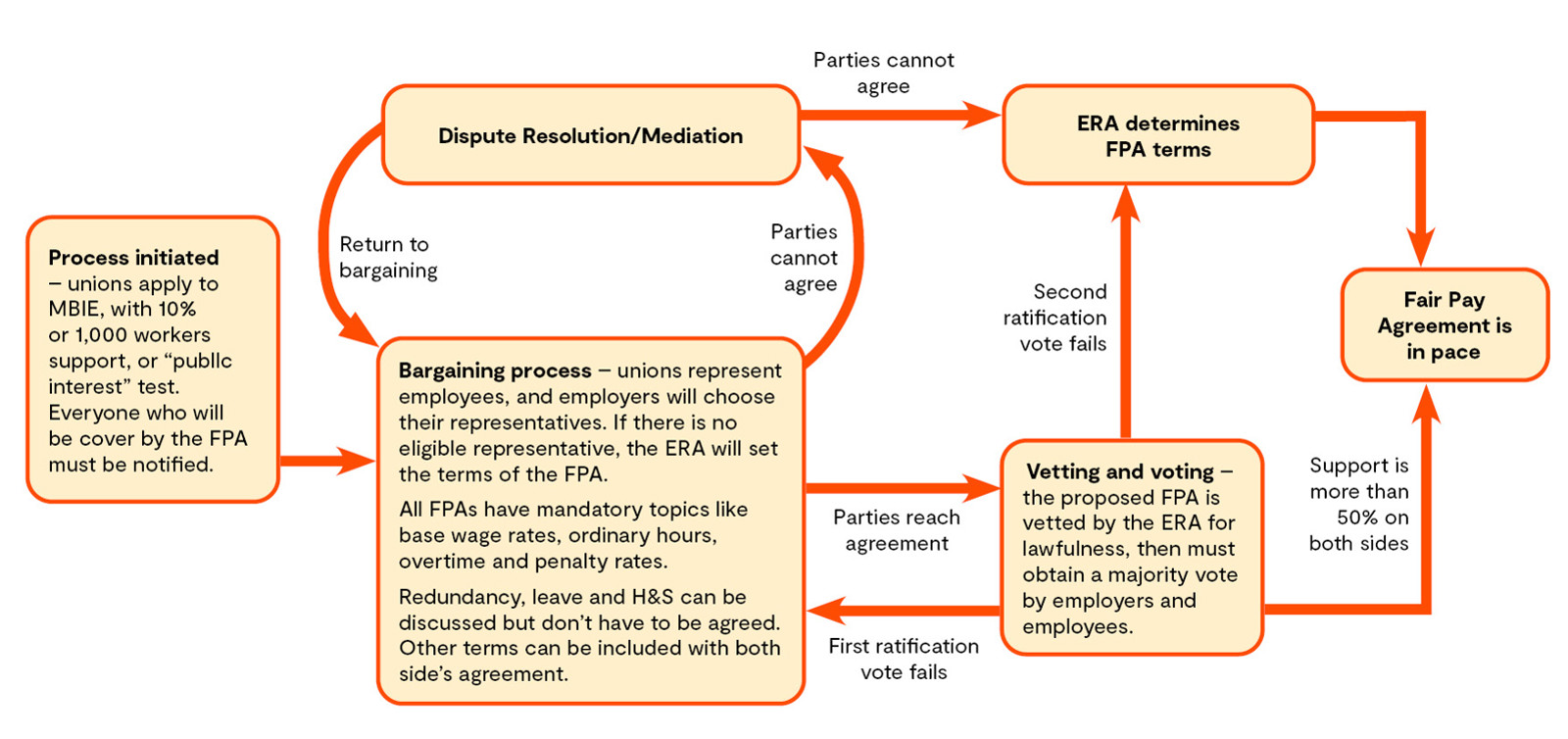

Our simple diagram explaining the bargaining process can be found at the end of this article.

What should employers be doing now?

Keep an eye out for FPA activity that may affect your business. The FPA regime is targeted toward workers and sectors that are relatively low paid, often operating close to the minimum wage. Many companies and industries will not be affected. However, FPA applications will be drafted broadly (or even vaguely) to widen the potential scope.

Check that there is an appropriate employers association that can (and is willing to) act as bargaining party for employers in your sector. Best practice will be to communicate with similar businesses to figure out the most appropriate entity to advocate for you. BusinessNZ may also be able to offer support and resources to assist with bargaining.

Know what your priorities are if you enter FPA bargaining. Consider what you think the minimum entitlements should be for your workers, and what you are willing to negotiate. Being clear and communicative with other affected employers will help the employer bargaining side negotiate effectively.

Assign staff to FPA-related responsibilities and ensure that they are appropriately resourced. An FPA will likely create more work for your human resources department, especially during the initial months (notifying employees, entering inter-party agreements and bargaining) and there will be ongoing work generated by any variation bargaining to the FPA and FPA renewals.

How can I know if my business is affected by, or should be involved in, an FPA?

Once an FPA application is approved, the union that applied to commence FPA bargaining is obliged by law to use their “best endeavours” to inform affected employers of the application within 15 working days. The union must also publish a notice on its website and in the relevant major daily newspapers. The first few applications will be high profile and so we expect most employers will hear that an application has been granted via the media.

Employers should therefore check news platforms as well as the Dashboard, for any notices to commence FPAs that may affect them or their employees.

What if my business is already party to a collective employment agreement?

Employers can be party to both a collective employment agreement and an FPA. The two agreements will run alongside each other and where there is a difference in provisions – e.g. annual leave or sick leave – the most generous provision will apply.

What is an FPA?

FPAs are sector-wide agreements that set minimum entitlements for all workers within the FPA’s scope. Coverage can be based on occupation or industry. Employers will have no say in whether an FPA will be set up in their industry (but they will be entitled to vote in favour or against the agreement), and they will be bound by the minimum entitlements set by the FPA.

Unions can initiate FPA bargaining if they pass one of three tests:

- Either sign up 1,000 employees, or 10% of the employees in the industry, to be covered by the FPA; or

- Persuade MBIE that it is in the public interest that an FPA govern the minimum entitlements available to employees within the sector or industry.

Bargaining sides (one for employees, one for employers) must be formed within three months of MBIE’s approval to initiate bargaining.

What terms will an FPA contain?

The terms required under the FPA legislation are:

- The date the FPA comes into force;

- The work the FPA covers;

- The standard hours of work for each type of work covered, and for each class of covered employees;

- Wage details for each type of work covered by the FPA, including the:

- Minimum base wage rate;

- Overtime rate;

- Penalty rate; and

- In relation to each wage rate —

- The specified amount by which it must be adjusted; or

- The calculation that must be used to adjust it;

- Arrangements for training and development;

- Leave entitlements;

- Applicable governance arrangements;

- The process the bargaining sides must follow if one side wishes to vary FPA terms; and

- The FPA’s expiry date.

Who are the bargaining parties?

Employers will not have an individual voice at the bargaining table. Bargaining can only be conducted through bargaining parties. Unions will bargain for employees and employer bargaining parties can be eligible employer associations, eligible state sector employers, or the employer default bargaining party.

To be accepted by MBIE as an employer bargaining party, the employer association must:

- Have at least one member who employs at least one covered employee (covered employer) under the proposed FPA

- Be an incorporated society with a registered constitution that enables the entity to represent the collective interests of covered employers for the purposes of bargaining a proposed FPA (or variation), and

- Be independent of any union or worker organisation and have a registered constitution that is democratic, reasonable, not unfairly discriminatory nor unfairly prejudicial, and not contrary to any law.

An employer default bargaining party may step in for the employer bargaining side if no eligible employer associations are available, or in the event that all the employer bargaining parties exit the process. The Fair Pay Agreement Regulations refer to BusinessNZ as the default employer bargaining party, and so it has the right to elect to play that role. However to date BusinessNZ has indicated that that it will not take on the role of default negotiator and instead will only provide support and assistance to businesses.

Each bargaining side must enter into an inter-party side agreement and appoint a bargaining side lead advocate to act as the side’s primary spokesperson and to represent or chair the bargaining side during the negotiations.

What are my obligations through the bargaining process?

Employers’ obligations include:

- The duty of good faith. This is similar to the duty of good faith under the Employment Relations Act but applies between bargaining parties on the same bargaining side (section 18), and on different bargaining sides (section 19) and in other respects (as listed under section 20 of the Act)

- Provision of electronic records of employee contact details to the initiating union as soon as practicable or within 30 working days of providing the required information to employees. This deadline can be extended to 60 working days if new employees are engaged during the bargaining process. Employees can opt out of providing their information

- Supplying any information sought where the request is in writing and specifies:

- The nature of the information in sufficient detail to enable the information to be identified

- The claim, or the response to a claim, in respect of which the information is sought, and

- A reasonable time within which the information must be provided

- Ensure that information obtained or provided during bargaining is only used for the purposes of the bargaining and is treated as confidential and not disclosed beyond the persons engaged in the bargaining

- Use their best endeavours to represent the collective interests of all covered employers

- Use their best endeavours to ensure that Māori employers are represented effectively in the bargaining process

- Allow their covered employees to attend two two-hour FPA meetings and pay them their usual pay rate for the time taken to attend those meetings

- Allow an employee representative to access their workplace. Small employers may be exempt on narrow religion-based grounds

- Not employ workers as contractors to avoid them being included as an employee under an FPA, and

- Comply with any obligations imposed by the Act in the event that an agreement is not reached. Maximum penalties for non-compliance by an employer are $40,000.

What happens if the parties can't agree?

Parties enter dispute resolution if they cannot agree on terms during the bargaining process. If, following dispute resolution, the parties still cannot agree then the Employment Relations Authority will determine the terms of the FPA.

Quick links to other Brief Counsels relevant to this topic

Chapman Tripp commentary: Fair Pay Agreements Act passes

Chapman Tripp podcast: Fair Pay Agreements Act – game changer or dead meat?

Fair Pay Agreements Act

FPA System