Contents

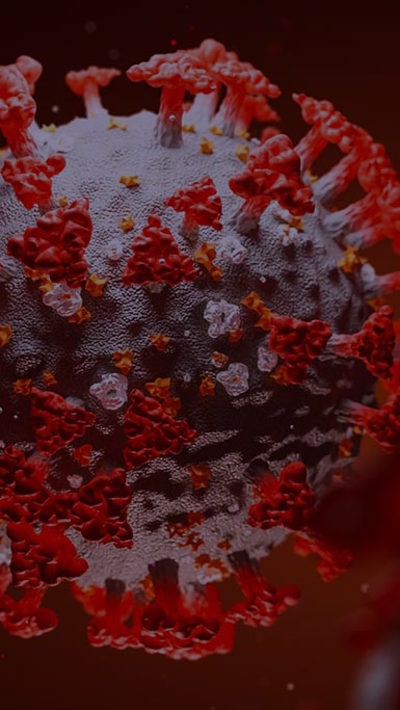

As COVID-19 has spread, share markets globally have been highly volatile and have come off significantly from record highs. Global supply chains are breaking down and each day seems to bring worse news, with one major bank now predicting a recession in New Zealand.

On March 9, Air New Zealand withdrew its earnings guidance after having already issued a profit downgrade two weeks earlier because it can no longer reliably assess the impact of recent events on its business.

Volatility of this magnitude creates significant compliance and disclosure issues for listed issuers. To assist, we have provided a checklist of practical advice on how to navigate the coronavirus storm.

Continuous disclosure

The Air New Zealand announcement demonstrates the challenge facing issuers when the global economy is in tumult. Effectively withdrawing its guidance after earlier providing a 24 February prediction of a $35m to $75m hit to its projected earnings this year, Air New Zealand said:

“The financial impact is likely to be more significant than previously estimated and the situation is evolving at such a rapid pace that the airline is not in a position to provide an earnings outlook to the market at this time. An update on earnings expectations will be provided when appropriate”.

Issuers need to continuously assess whether they are complying with their fundamental obligation to release material information without delay, unless one of the exceptions within the NZX Listing Rules applies.

Detail about the progression of COVID-19 and its expected effects is publicly available. However, each issuer will be affected in different ways. The impact on individual issuers and in particular the implications on financial performance may be material information requiring disclosure.

As the possible range of impacts broadens, management and boards should work through their contingency planning with an eye to their market communications and whether any potential risks to performance are sufficiently material to warrant disclosure.

In this context, it is worth noting that World Bank research suggests that as much as 80% to 90% of the economic cost of epidemics is due to behavioural changes once extreme risk aversion sets in. These include increased absenteeism, sharply reduced consumption and volatile shifts in supply and demand.

Ordinarily, internal management information (such as revised forecasts) need not be disclosed. However, each issuer should consider whether:

- any past statements need to be corrected or supplemented in light of the information now available to management and the board. Past statements that may merit particular consideration include both formal guidance and statements which have the effect of providing guidance, such as statements as to how trading is expected to look compared to the past financial year. As Air New Zealand demonstrated, what may be required is a communication to the market to acknowledge that it is just too hard to reliably predict what the impact may be and therefore prior guidance should not be relied upon

- there is sufficient variation to constitute material information between the issuer’s internal view and market expectations as to its financial performance for the upcoming financial reporting period (when taking into account factors such as its share price, any guidance from the issuer, analyst consensus and the past performance of the issuer). As AFT Pharmaceuticals’ recent announcement demonstrated, market expectations can be unduly negative and resetting them may be critically important to preserving shareholder value in the face of generally negative sentiment.

Given the far reaching effects of COVID-19 and the accompanying disruption to the global economy, we expect that many issuers will feel it is appropriate from an investor relations perspective to pass comment on their trading and market conditions, even if not strictly required to do so.

Boards and management should stop and consider whether any such announcement contains material information, as this will determine whether the announcement should be marked as price sensitive and the time within which an issuer must release the announcement.

Annual results and reporting

The upcoming reporting season for issuers with 31 March balance dates creates additional complexity. It is always tempting to delay updates to the market in the period before financial year end results are definitively known but this is not an option for the release of material information – unless one of the exceptions to disclosure applies.

Management and boards will also need to consider what statements they can, and should, make about COVID-19 and the impact on their business in the investor presentations and management discussion and analysis associated with financial reporting. As noted above, we expect that many issuers will feel some comment is merited, and this is consistent with reporting trends offshore.

Finally, monitoring of post-balance date events will be even more critical than usual. Careful attention will need to be paid to developments after 31 March to ensure that adjusting and non-adjusting events are well understood and carefully disclosed (see NZ IAS 10 which prescribes when an entity should adjust its financials for events after the reporting period as circumstances may change significantly between the balance date and the reporting date).

Capital raising in a volatile environment

A challenging market environment may force an issuer to raise equity capital or capital raising plans already in motion may need to continue to enable growth plans to be executed. The underwritten $100m rights offer announced yesterday by Asset Plus illustrates that even in the face of market volatility, capital raisings can continue. When raising capital in the current environment issuers should be aware that they will likely need to:

- accept some COVID-19 targeted termination events in any underwriting commitment (as occurred during the SARS and H1N1 outbreaks) and generally more underwriter favourable termination positions

- address in its due diligence processes and market announcements in connection with the capital raising the expected impact of COVID-19 on business performance now and in the future, and

- pay more for underwriting.

Opportunistic takeovers

In any period of market turbulence, issuers should consider refreshing their takeover protocols. Boards in particular should be prepared to assess any take-private bids carefully, as it is very difficult in an unsettled market for intrinsic value to be reliably assessed and to form a view on whether the proposal should be recommended to shareholders.

LTI schemes

The effect on long term incentive (LTI) schemes should be assessed by issuers once the dust settles. Many LTI schemes include performance hurdles which are pegged to the share price performance of the issuer (whether directly or through a total shareholder return metric).

Where an issuer’s business performance has stayed strong but its share price has fallen in response to extraneous factors, the board may have discretion under the rules of the scheme to adjust performance hurdles, or deem them to have been met, so as to allow for vesting to occur to the extent that the share price underperformance reflects a downtrend in wider equity markets.

While it may be too early now to assess whether any discretion should be exercised, boards and remuneration committees may wish to refresh themselves with the scope of any such discretion allowed for in the issuer’s LTI scheme, and consider the approach that would be taken to exercising it.

Implications for corporate governance

Given Recommendation 6.1 of the NZX Corporate Governance Code, we expect that most issuers will have already have a robust risk management framework in place. But the COVID-19 outbreak may prove a timely reminder to ensure it remains fit for purpose and covers matters such as business continuity and contingency planning, exploration of alternative suppliers and emergency communications procedures.