Contents

Chapman Tripp is pleased to have advised Kathmandu Holdings Limited on a three year AU$300m debt refinancing facility which includes, at AU$100m, the largest syndicated sustainability linked loan (SLL) to be established by a New Zealand corporate.

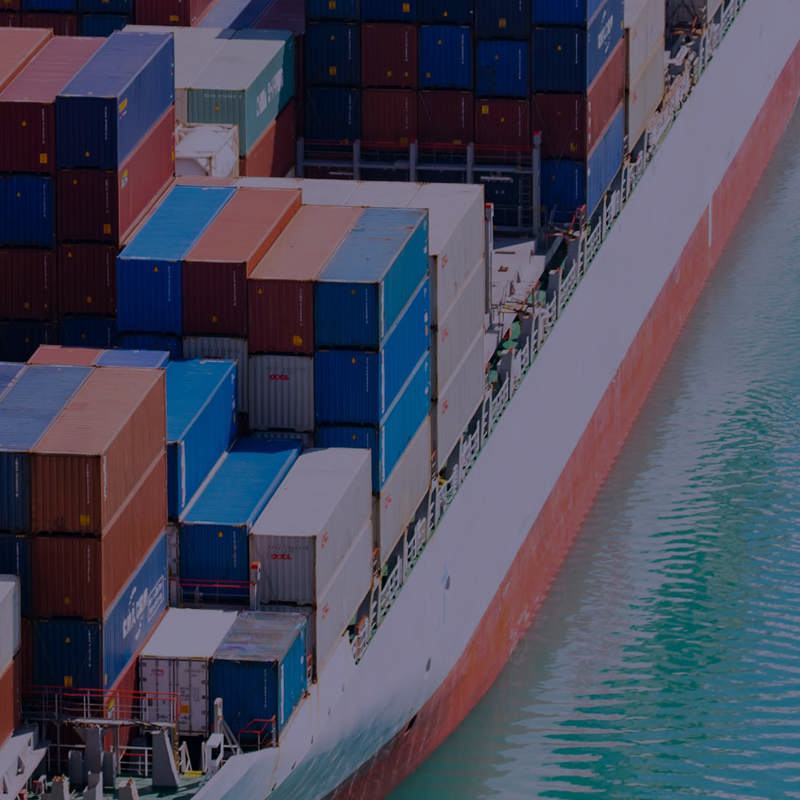

The SLL is linked to the achievement of targets around greenhouse gas emission reductions and improved transparency, wellbeing and labour conditions throughout Kathmandu’s supply chain.

Chapman Tripp is a market leader in sustainable finance in New Zealand, with a breadth of experience advising clients on sustainability-linked and green financing options.

The AU$300m package reduces Kathmandu’s borrowing costs and provides it with a significant liquidity cushion to provide safe passage through any continuing COVID-19 volatility.

Chapman Tripp Finance Partner Cathryn Barber, and Senior Associate Hayden Reyngoud, led the team of experts advising Kathmandu.

“There is always a double pleasure in securing these good-for-the-economy/good-for-the-planet deals so we are grateful to Kathmandu for providing us with this opportunity to further develop what is already a significant area of expertise for the firm”, Barber said.

Kathmandu Holdings Group CFO Chris Kinraid commented:

Sustainability is in our DNA and is a core foundation of the Group, linking our financial arrangements to our sustainability goals made perfect sense. It reinforces to our shareholders and stakeholders that we are committed to sustainability across all aspects of our Group.